- ভাটিয়ালি

- এ হল কথা চালাচালির পাতা। খোলামেলা আড্ডা দিন। ঝপাঝপ লিখুন। অন্যের পোস্টের টপাটপ উত্তর দিন। এই পাতার কোনো বিষয়বস্তু নেই। যে যা খুশি লেখেন, লিখেই চলেন। ইয়ার্কি মারেন, গম্ভীর কথা বলেন, তর্ক করেন, ফাটিয়ে হাসেন, কেঁদে ভাসান, এমনকি রেগে পাতা ছেড়ে চলেও যান।

যা খুশি লিখবেন। লিখবেন এবং পোস্ট করবেন৷ তৎক্ষণাৎ তা উঠে যাবে এই পাতায়। এখানে এডিটিং এর রক্তচক্ষু নেই, সেন্সরশিপের ঝামেলা নেই৷ এখানে কোনো ভান নেই, সাজিয়ে গুছিয়ে লেখা তৈরি করার কোনো ঝকমারি নেই। সাজানো বাগান নয়, ফুল ফল ও বুনো আগাছায় ভরে থাকা এক নিজস্ব চারণভূমি। এই হল আমাদের অনলাইন কমিউনিটি ঠেক। আপনিও জমে যান। বাংলা লেখা দেখবেন জলের মতো সোজা। আসুন, গড়ে তুলি এক আড়ালহীন কমিউনিটি। - গুরুভার আমার গুরু গুরুতে নতুন? বন্ধুদের জানান

- মতামত দিন

-

বিষয়বস্তু*:

more oil from US to Europe | 2405:8100:8000:5ca1::196:***:*** | ১৩ মে ২০২২ ০৯:০৭502096

more oil from US to Europe | 2405:8100:8000:5ca1::196:***:*** | ১৩ মে ২০২২ ০৯:০৭502096- Russia’s Oil Industry Is Suffering As The West Shuns Its CrudeRussia’s oil industry—a vital source of budget revenues—is already showing signs of slowdown as Western buyers shun Russian oil while Moscow struggles to replace lost sales in the West with sales in emerging Asian markets.In the first ten days of April, Russia’s crude oil and condensate production slumped to an average of 10.365 million bpd, data obtained by Energy Intelligence showed this week. That’s more than 600,000 bpd below the March average crude and condensate output of 10.996 million bpd.According to the IEA, Russian oil supply and exports continue to fall, with April losses expected to average 1.5 million bpd as Russian refiners extend run cuts, more buyers shun barrels, and Russian storage fills up. From May onwards, nearly 3 million bpd of Russian production could be offline due to international sanctions and self-sanctioning from buyers.Due to the sanctions on Russia, fuel oil deliveries have plunged and storage is brimming with fuel, Vagit Alekperov, the president of Russia’s second-largest oil producer Lukoil, wrote at the end of March in a letter to Deputy Prime Minister Alexander Novak obtained by Russian daily Kommersant.---------------More Oil From U.S. Strategic Petroleum Reserve Heads To EuropeMay 12, 2022, 1:00 PM CDTEurope is set to receive more cargoes of U.S. crude from the Strategic Petroleum Reserve (SPR) as the European Union discusses an oil embargo on Russia and looks to reduce reliance on Russian oil, Bloomberg reported on Thursday, citing tanker-tracking data and sources with knowledge of the shipments.

In recent weeks, Europe has increased purchases of U.S. crude as it considers the details of a ban on imports of Russian crude and refined products.In April, some 1.6 million barrels of U.S. crude from the strategic reserve made its way to Europe, Smith told Bloomberg, adding: “That’s the largest amount of SPR crude that’s been shipped to the continent based on historical monthly data.”

Ура | 2405:8100:8000:5ca1::17:***:*** | ১৩ মে ২০২২ ০৮:২৪502095

Ура | 2405:8100:8000:5ca1::17:***:*** | ১৩ মে ২০২২ ০৮:২৪502095

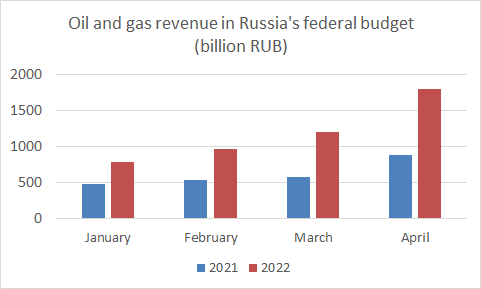

Janis Kluge

@jakluge

New data! #Russia's oil and gas revenues hit another record high in April. 1.8 trillion rubles in a single month, after 1.2 trillion in March. After only 4 months, Russia's federal #budget has now already received 50% of the planned oil and gas revenue for 2022 (9.5 trillion).

6:24 PM · May 6, 2022·Twitter Web App

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৮:০৬502094

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৮:০৬502094- যাদবপুরের ওই অঞ্চলে অনেক তো গবেষণাগার, বেশ কটাতেই গিয়েছিলাম আমরা। সিজিসিআরাই তে বেশ মজার অভিজ্ঞতা হয়েছিল। লেজার আবিষ্কার নিয়ে বলতে গিয়ে এক বিজ্ঞানী ভদ্রলোক বলছিলেন অমুক গট নোবেল প্রাইজ ফর ইট, অ্যান্ড অমুক গট কাঁচকলা ফর ইট। ঃ-)

kk | 2601:448:c400:9fe0:854a:c977:caff:***:*** | ১৩ মে ২০২২ ০৭:৫৬502093

kk | 2601:448:c400:9fe0:854a:c977:caff:***:*** | ১৩ মে ২০২২ ০৭:৫৬502093- অ্যান্ডর, হয়তো তোমাকে ক্যান্টিনে ট্যান্টিনে দেখেওছিলাম :-)

S | 2405:8100:8000:5ca1::198:***:*** | ১৩ মে ২০২২ ০৭:৫১502092

S | 2405:8100:8000:5ca1::198:***:*** | ১৩ মে ২০২২ ০৭:৫১502092- থ্যাঙ্কু

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:৫১502091

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:৫১502091- ঈশ, একটা প্রোগ্রামের অংশ হয়ে আমরা আইএসিএস ভিজিট করতে গিয়েছিলাম। হয়তো তুমি তখন ওখানে ছিলে! ঃ-)

kk | 2601:448:c400:9fe0:854a:c977:caff:***:*** | ১৩ মে ২০২২ ০৭:৪৯502090

kk | 2601:448:c400:9fe0:854a:c977:caff:***:*** | ১৩ মে ২০২২ ০৭:৪৯502090- ফর দ্য*

kk | 2601:448:c400:9fe0:854a:c977:caff:***:*** | ১৩ মে ২০২২ ০৭:৪৮502089

kk | 2601:448:c400:9fe0:854a:c977:caff:***:*** | ১৩ মে ২০২২ ০৭:৪৮502089- S,

'ইন্ডিয়ান অ্যাসোশিয়েশন ফর কাল্টিভেশন অফ সায়েন্স' (IACS)এ খোঁজ নিতে পারেন। আমি ওখানে বায়োটেক ডিপার্টমেন্ট থেকেই পিএইচডি করেছিলাম। আমাদের ল্যাবেই ছেলেমেয়েরা মাস খানেকের সামার প্রোজেক্ট করেছে অনেকবার। আমার সুপারভাইজার এখন আর নেই। কিন্তু কেউ না কেউ হয়তো এখনও করান।

Amit | 103.23.***.*** | ১৩ মে ২০২২ ০৭:৪২502088

Amit | 103.23.***.*** | ১৩ মে ২০২২ ০৭:৪২502088- দিদির ভাইদের খেলা হচ্ছে তো চাদ্দিকেই। কেউ কেউ খেলাশেষে এক্কেরে বেলাশেষে চলে যাচ্ছে অবশ্য।

S | 2405:8100:8000:5ca1::af:***:*** | ১৩ মে ২০২২ ০৭:৪০502087

S | 2405:8100:8000:5ca1::af:***:*** | ১৩ মে ২০২২ ০৭:৪০502087- কোলকাতায় বা আশে পাশে বা অন্য রাজ্যে বায়োটেকনজলির আন্ডারগ্র্যাডের এক মাসের সামার ট্রেনিংএর ব্যবস্থা আছে?

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:৩৯502086

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:৩৯502086- বলা যায় না, এ যা চলছে, মহান ভারতের সদাশয় সরকার বাহাদুর হয়তো মহিলাদের কিছু বিশেষ চাকরি ছাড়া অন্য চাকরি করা বন্ধই করে দিল! এমনিতেই তো শোনা যাচ্ছে কিছু কিছু মহল্লায় মন্দির তৈরী করে দিচ্ছে, সেখানে পুজো দর্শন করে দুপুরে ফ্রী খেতে পান স্থানীয় মহিলারা আর মাসে মাসে কিছু ভাতা পান।

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:৩৬502085

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:৩৬502085- কবি বলেছেন "খেলা হবে " .তবে কোথায়, কবে , কেন সে ব্যাপারে কবি নীরব .!!

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:২৯502084

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:২৯502084- ভাঙা পা, ব্যান্ডেজ বাঁধা, সেই অবস্থায় বসে বসে বক্তৃতা দিচ্ছেন জনসভায়, তার কী ফ্লো, কী থ্রো! যাকে বলে যুগ নেতা! নন্দীগ্রামের সেই ভিলেনকে কটাক্ষ করে,"তোমার সায় ছাড়া এ তো হয় না হে বাপু! হয় না।" কোথায় লাগে মহাপুরুষ সিনেমার বিরিঞ্চিবাবা! ঃ-)

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:২৬502083

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:২৬502083- এর আরেক টা ভার্সন আছে আতাগাছে তোতাপাখিডালিম গাছে মৌকাল রাতে মদ খেয়েছিহেব্বি কেলিয়েছে বৌ

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:২৫502082

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৭:২৫502082- আপনারা যাই বলুন, ঐ বক্তৃতাটা ছিল বিশুদ্ধ একটি কবিতা। "আমাকে চমকালে আমি ধমকাই, আমাকে ধমকালে আমি উৎরাই" , কিছুই বলতে পারলাম না, আরো অনেক কথা ছিল আর তার কী টোন, কী ফ্লো, কী থ্রো! উফ্ফ। ঃ-)

এটা কোন কবির লেখা? | 2405:8100:8000:5ca1::22a:***:*** | ১৩ মে ২০২২ ০৭:২২502081

এটা কোন কবির লেখা? | 2405:8100:8000:5ca1::22a:***:*** | ১৩ মে ২০২২ ০৭:২২502081- আতা গাছে তোতাপাখিডালিমগাছে মৌবিশ্বাস করো তুমিআমার একমাত্র বৌ

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৭:২১502080

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৭:২১502080- মানে দিদি ? তিনি তো সারাক্ষন যুদ্ধের মোডেই থাকেন। :)

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:২০502079

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:২০502079- আচ্ছা যুদ্ধ কবে শেষ হবে সেই নিয়ে কবি কিছু বলেছেন নাকি?

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৭:১৮502078

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৭:১৮502078- অবশ্য এই ট্রেন্ড টা কিছুটা গ্লোবালি ও ঘটেছে। অনেকটাই কোরোনার জন্যে। আমাদের এখানে যেটুকু দেখা , বিশেষ করে বহু মহিলা হসপিটালিটি বা সার্ভিস ইন্ডাস্ট্রিতে আছেন। দু বছর ধরে সবরকম ট্রাভেল বন্ধ ছিল। সমস্ত রিলেটেড বিজনেস ও বন্ধ। দেখা যাক এবার হয়তো ইম্প্রুভ করবে। সবই পুতিনের দয়া।

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:১৪502077

Apu | 2401:4900:314d:e0e7:bdcf:9840:7eb7:***:*** | ১৩ মে ২০২২ ০৭:১৪502077- অমিত , আটোজ দিনকাল কেমন কাটছে হে? দুষ্টু লোকে বলে"কেটে যাচ্ছে কিন্তু রক্ত পরছে না "

Abhyu | 2409:4060:2e1d:32cd:8089:ad0d:7e31:***:*** | ১৩ মে ২০২২ ০৭:০৯502076

Abhyu | 2409:4060:2e1d:32cd:8089:ad0d:7e31:***:*** | ১৩ মে ২০২২ ০৭:০৯502076- মহিলারা চাকরি ছেড়ে পুণ্য স্বামীসেবায় ও সন্তানপালনে রত হবেন। ভারত আবার জগতসভায় শ্রেষ্ঠ আসন লবে।

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৭:০৬502075

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৭:০৬502075- আচ্ছা দিদি ও মোদির মতো মাত্তর ২-৩ ঘন্টাই ঘুমোন ? নাহলে সারাদিন অ্যাডমিন , দলাদলি ,ভাইপো র সোনা ,অনুব্রত র কয়লা এতো কিছু সামলে এরকম কয়েকশো হই কোয়ালিটি কোবতে নামানোর টাইম পান কোথেকে ?হয়তো সেই জন্যেই এতো মেজাজ তিরিক্ষি হয়ে থাকে তেনার। অনিদ্রার ফল।

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৬:৫২502074

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৬:৫২502074- লিখতে হবে-

"সকালে উঠিয়া আমি মনে মনে বলি

সারাদিন যেন আমি কবিতায় চলি" :-)

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৬:৪১502073

Amit | 103.6.***.*** | ১৩ মে ২০২২ ০৬:৪১502073- শুধু সুপ্রভাত বললে হবে ? কবিতাও লিখতে হবে রোজ ভোরে উঠে। নাহলে দিদির এতো অনুপ্রেরণা যাবে কোদ্দিয়ে ?

-

Bratin Das | ১৩ মে ২০২২ ০৬:৩৯502072

Bratin Das | ১৩ মে ২০২২ ০৬:৩৯502072 - সুপ্রভাত গুরু

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৪:১৮502071

&/ | 151.14.***.*** | ১৩ মে ২০২২ ০৪:১৮502071- এত বিশাল সংখ্যক মহিলা চাকরি ছেড়ে দিয়েছেন বলছে এই খবরে।

https://www.anandabazar.com/lifestyle/20-million-indian-women-quit-work-in-five-years-and-this-is-the-greatest-resignation-ever-dgtl/cid/1343970

kc | 188.7.***.*** | ১৩ মে ২০২২ ০০:৫৬502070

kc | 188.7.***.*** | ১৩ মে ২০২২ ০০:৫৬502070- অত ঠান্ডা হাওয়া নেবেননা, বাধ্যবাধকতাগুলোও দেখে নেবেন, খুঁটিয়ে পড়ুন,

S | 2a03:e600:100::***:*** | ১৩ মে ২০২২ ০০:৩৪502069

S | 2a03:e600:100::***:*** | ১৩ মে ২০২২ ০০:৩৪502069- সিডিশান ল স্থগিত করার নির্দেশটা তো গুমোট পরিবেশে হঠাতই একটু ফুরফুরে ঠান্ডা হাওয়ার মতন।

hihi | 167.88.***.*** | ১৩ মে ২০২২ ০০:০৮502068

hihi | 167.88.***.*** | ১৩ মে ২০২২ ০০:০৮502068- অপূর্ব লিখেছেন বিতানবাবু। এইটে মনে পড়ে গেল-নদীর শব্দ ছাপিয়ে শোনা যাচ্ছে লালমোহনবাবুর সুর করে বলা, ওরে তোরা কি জানিস কেউ, জলে কেন এত ওঠে ঢেউ। আমার দৃঢ় বিশ্বাস উনি পুরো কবিতাটার কেবলমাত্র ওই দুটো লাইনই জানেন।শেষে ফেলুদা আর থাকতে না পেরে লাইন যোগ করতে শুরু করে দিল—ওরে তোরা কি জানিস কেউ, কেন বাঘ এলে ডাকে ফেউ…ওরে তোরা কি শুনিস কেউ, কুকুরের ঘেউ ঘেউ, খোকা কাঁদে ভেউ ভেউ…

-

Bitan Polley | ১৩ মে ২০২২ ০০:০১502067

- কোন এক স্বপ্নের শহরে নতুন এক ভোর ,

হালকা বাতাস পলাশ ফুলের রাস্তা সাজানো ।

তোর ,

কোন এক শহরে নতুন এক ভোর ,

ফুটপাত ঘিরে বেড়ে চলা দোকান ,

আগুন জ্বলতে থাকে অবাক ছলে বোঝে না কেউ ।

কোন এক শহরে তুই হো সাজানো কোন এক ঢেউ ।

অবাক ছলে মাতিয়ে তোলা ফিরিয়ে দেওয়া কেউ ।

তুই হো নদীর সাথে বাঁধন ছাড়া শাখা ,

পদ্মলোচন তোর আঁখির তলায় আজো কেন ব্যাথা।

- মতামত দিন

-

বিষয়বস্তু*:

-

গুরুচণ্ডা৯-র বই দত্তক নিন

কোনোরকম কর্পোরেট ফান্ডিং ছাড়া সম্পূর্ণরূপে জনতার শ্রম ও অর্থে পরিচালিত এই নন-প্রফিট এবং স্বাধীন উদ্যোগটিকে বাঁচিয়ে রাখতে এককালীন বা ধারাবাহিক ভাবে গুরুভার বহন করুন।

- ভাটিয়ালি | টইপত্তর | বুলবুলভাজা | হরিদাস পাল | খেরোর খাতা | বই

- বুলবুলভাজা : সর্বশেষ লেখাগুলি

(লিখছেন... হীরেন সিংহরায়)

(লিখছেন... Aditi Dasgupta, হীরেন সিংহরায়, Sara Man)

(লিখছেন... হীরেন সিংহরায়, শিবাংশু, রমিত চট্টোপাধ্যায়)

(লিখছেন... )

(লিখছেন... Srimallar, .)

- হরিদাস পালেরা : যাঁরা সম্প্রতি লিখেছেন

(লিখছেন... dc, kk, দ)

(লিখছেন... bikarna, bikarna, .)

(লিখছেন... )

(লিখছেন... :|:, aranya, dc)

(লিখছেন... )

- টইপত্তর : সর্বশেষ লেখাগুলি

(লিখছেন... Srimallar)

(লিখছেন... Bratin Das)

(লিখছেন... সচ্চরিত্র, albert banerjee)

(লিখছেন... )

(লিখছেন... )

- কি, কেন, ইত্যাদি

- বাজার অর্থনীতির ধরাবাঁধা খাদ্য-খাদক সম্পর্কের বাইরে বেরিয়ে এসে এমন এক আস্তানা বানাব আমরা, যেখানে ক্রমশ: মুছে যাবে লেখক ও পাঠকের বিস্তীর্ণ ব্যবধান। পাঠকই লেখক হবে, মিডিয়ার জগতে থাকবেনা কোন ব্যকরণশিক্ষক, ক্লাসরুমে থাকবেনা মিডিয়ার মাস্টারমশাইয়ের জন্য কোন বিশেষ প্ল্যাটফর্ম। এসব আদৌ হবে কিনা, গুরুচণ্ডালি টিকবে কিনা, সে পরের কথা, কিন্তু দু পা ফেলে দেখতে দোষ কী? ... আরও ...

- আমাদের কথা

- আপনি কি কম্পিউটার স্যাভি? সারাদিন মেশিনের সামনে বসে থেকে আপনার ঘাড়ে পিঠে কি স্পন্ডেলাইটিস আর চোখে পুরু অ্যান্টিগ্লেয়ার হাইপাওয়ার চশমা? এন্টার মেরে মেরে ডান হাতের কড়ি আঙুলে কি কড়া পড়ে গেছে? আপনি কি অন্তর্জালের গোলকধাঁধায় পথ হারাইয়াছেন? সাইট থেকে সাইটান্তরে বাঁদরলাফ দিয়ে দিয়ে আপনি কি ক্লান্ত? বিরাট অঙ্কের টেলিফোন বিল কি জীবন থেকে সব সুখ কেড়ে নিচ্ছে? আপনার দুশ্চিন্তার দিন শেষ হল। ... আরও ...

- বুলবুলভাজা

- এ হল ক্ষমতাহীনের মিডিয়া। গাঁয়ে মানেনা আপনি মোড়ল যখন নিজের ঢাক নিজে পেটায়, তখন তাকেই বলে হরিদাস পালের বুলবুলভাজা। পড়তে থাকুন রোজরোজ। দু-পয়সা দিতে পারেন আপনিও, কারণ ক্ষমতাহীন মানেই অক্ষম নয়। বুলবুলভাজায় বাছাই করা সম্পাদিত লেখা প্রকাশিত হয়। এখানে লেখা দিতে হলে লেখাটি ইমেইল করুন, বা, গুরুচন্ডা৯ ব্লগ (হরিদাস পাল) বা অন্য কোথাও লেখা থাকলে সেই ওয়েব ঠিকানা পাঠান (ইমেইল ঠিকানা পাতার নীচে আছে), অনুমোদিত এবং সম্পাদিত হলে লেখা এখানে প্রকাশিত হবে। ... আরও ...

- হরিদাস পালেরা

- এটি একটি খোলা পাতা, যাকে আমরা ব্লগ বলে থাকি। গুরুচন্ডালির সম্পাদকমন্ডলীর হস্তক্ষেপ ছাড়াই, স্বীকৃত ব্যবহারকারীরা এখানে নিজের লেখা লিখতে পারেন। সেটি গুরুচন্ডালি সাইটে দেখা যাবে। খুলে ফেলুন আপনার নিজের বাংলা ব্লগ, হয়ে উঠুন একমেবাদ্বিতীয়ম হরিদাস পাল, এ সুযোগ পাবেন না আর, দেখে যান নিজের চোখে...... আরও ...

- টইপত্তর

- নতুন কোনো বই পড়ছেন? সদ্য দেখা কোনো সিনেমা নিয়ে আলোচনার জায়গা খুঁজছেন? নতুন কোনো অ্যালবাম কানে লেগে আছে এখনও? সবাইকে জানান। এখনই। ভালো লাগলে হাত খুলে প্রশংসা করুন। খারাপ লাগলে চুটিয়ে গাল দিন। জ্ঞানের কথা বলার হলে গুরুগম্ভীর প্রবন্ধ ফাঁদুন। হাসুন কাঁদুন তক্কো করুন। স্রেফ এই কারণেই এই সাইটে আছে আমাদের বিভাগ টইপত্তর। ... আরও ...

- ভাটিয়া৯

- যে যা খুশি লিখবেন৷ লিখবেন এবং পোস্ট করবেন৷ তৎক্ষণাৎ তা উঠে যাবে এই পাতায়৷ এখানে এডিটিং এর রক্তচক্ষু নেই, সেন্সরশিপের ঝামেলা নেই৷ এখানে কোনো ভান নেই, সাজিয়ে গুছিয়ে লেখা তৈরি করার কোনো ঝকমারি নেই৷ সাজানো বাগান নয়, আসুন তৈরি করি ফুল ফল ও বুনো আগাছায় ভরে থাকা এক নিজস্ব চারণভূমি৷ আসুন, গড়ে তুলি এক আড়ালহীন কমিউনিটি ... আরও ...

- টইপত্তর, ভাটিয়া৯, হরিদাস পাল(ব্লগ) এবং খেরোর খাতার লেখার বক্তব্য লেখকের নিজস্ব, গুরুচণ্ডা৯র কোন দায়িত্ব নেই। | ♦ : পঠিত সংখ্যাটি ১৩ই জানুয়ারি ২০২০ থেকে, লেখাটি যদি তার আগে লেখা হয়ে থাকে তাহলে এই সংখ্যাটি সঠিক পরিমাপ নয়। এই বিভ্রান্তির জন্য আমরা দুঃখিত।

গুরুচণ্ডা৯-র সম্পাদিত বিভাগের যে কোনো লেখা অথবা লেখার অংশবিশেষ অন্যত্র প্রকাশ করার আগে গুরুচণ্ডা৯-র লিখিত অনুমতি নেওয়া আবশ্যক।

অসম্পাদিত বিভাগের লেখা প্রকাশের সময় গুরুতে প্রকাশের উল্লেখ আমরা পারস্পরিক সৌজন্যের প্রকাশ হিসেবে অনুরোধ করি।

যোগাযোগ করুন, লেখা পাঠান এই ঠিকানায় : guruchandali@gmail.com ।

মে ১৩, ২০১৪ থেকে সাইটটি

বার পঠিত